Digital transformation was already a top priority for banks as they were facing extreme competition from much larger banks and fintech companies. The main challenge for banks is to stay ahead of others by offering faster and more convenient customer service options. But with the ongoing pandemic, banks are facing uncertainty and much tougher challenges to stay afloat. The demand for providing the best online services has gone up by 150% in the last one and half years.

According to an IBM study over 80% of the world’s enterprise data is on mainframe systems, which as a technology is now more than 50 years old. Most banks have a history of sticking to mainframe-based systems as their most preferred tech infrastructure to run daily operations. The primary barrier to adopting new technology is seen from managers' unwillingness to get away with age-old tech infrastructure as the preferred choice over new and untested tech advancements. Huge investment in an unknown territory is what drives these managers to stick to legacy technologies.

On the other hand, the mindset problem is also seen as a major roadblock, as senior bank executives have their way of looking at the technology right for their industry.

“According to Gartner research, by 2025 customer service organizations that embed AI in their multichannel customer engagement platforms will elevate operational efficiency by 25%.”

Pandemic is changing how banks should think in future

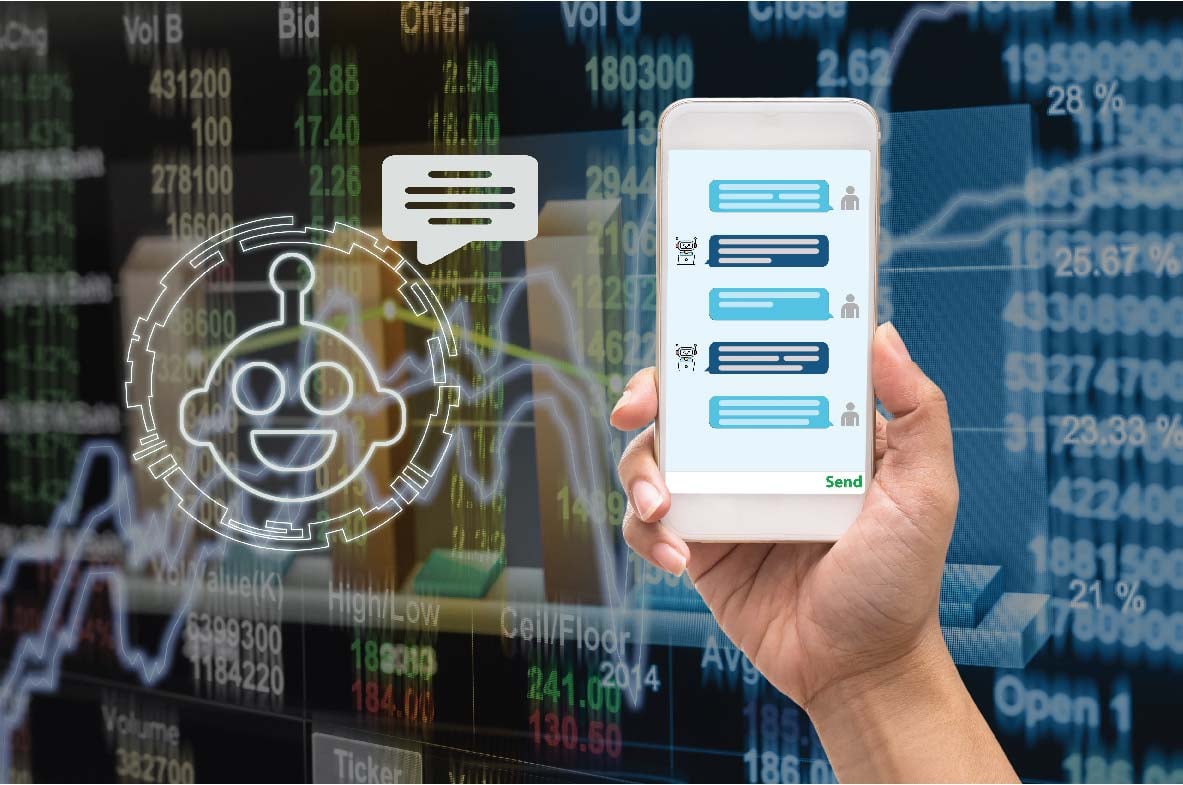

The COVID-19 pandemic has forced banks and other financial institutions to look at the future and make long-term investments in digital transformation through conversational AI. There is a visible dramatic shift with a sharp growth in interest for conversational AI in banking to reduce the pressure on contact centers. In most cases, conversational banking is linked to the form of chatbots powered by AI.

Technology can enable banks in several ways, from risk management and detecting fraud using AI or doing banking transactions from any part of the world through blockchain technology. But, something that stands out is the use of conversational AI for marketing and customer support in banks.

Banks have been trying Conversational AI, however with varying degrees of achievement. There have been obvious benefits that banks have been deriving after AI adoption, from offering personalized services to their customers to helping them with the right choice on loans, so that these customers always feel pampered and stay longer with the bank.

Also Read: How Conversational AI Creates New Business Avenues for Enterprises and ISVs

Chatbots mean anytime customer support

Conversational AI, especially chatbots is a big boon for banks, as it can engage directly with customers 24/7 and respond to their queries, giving relief to the bank’s customer care executives. Not only that AI-enabled chatbots can also assist the same customer executives by giving them hints on what to respond to the calling customers, or what real-time information they need to provide to the customers to make them feel happy. Chatbots play a key role in resolving customer queries faster, reduce waiting time for the clients to get the required answer, and restrain unhappy customers from escalating the matter to higher authorities.

Even chatbots are also evolving keeping pace with the rise in customers' demand and expectations. Chatbots developed earlier were only limited to simple scripts, they tend to fail if a slightly different conversation took place and could not deliver any meaningful response. Here comes Natural Language Processing (NLP) to rescue chatbots from such a situation. Natural Language Processing-based AI technologies have brought a huge change in how chatbots now interact with customers. Chatbots enabled with NLP technology are much better equipped to follow any complicated conversation with the customer, remember the context of the call, detect user intents, and resume a topic discussed earlier.

Also Read: How AI is Creating New Businesses

Leading banks using Conversational AI to engage customers

Leading American investment bank JPMorgan Chase is using an AI-based customer engagement platform for scanning and processing contracts and documentation much faster, saving the firm over 360,000 man-hours to date.

In Sweden, SEB Group a large financial group has deployed a Conversational AI chatbot called Amelia to help its employees solve internal problems and offer rapid, sustained tech support.

Banks can now scale with conversational AI and chatbot features that can answer your customers’ simple queries on the spot. Moreover, you can fish out actionable insights for you to build and innovate on your apps and services.

Innominds, Haptik partnership to drive conversational AI initiatives

To help businesses scale up conversational AI adoption, Innominds had earlier entered into a partnership with Haptik one of the largest conversational AI platforms in the world.

The partnership brings together these two AI engineering companies to enhance customer experiences and build the foundation for a future of contactless systems and seamless self-service transactions and processes.

“We are excited to have Haptik as our partner. Our mission to engineer a digital future gets strengthened with this partnership. We will be in a position to enable enterprises to adopt conversational AI on a larger scale to not only ride out the pandemic situation but also prepare for the future of AI-augmented human intelligence,” says Sairam Vedam, Chief Marketing Officer, Innominds.

Innominds solutions to help businesses become remote-first in post-pandemic environment

Mitigating COVID-19 and ensuring your business continues unhindered, our solutions support and strengthen your business to become Remote First. In this unprecedented situation, businesses across the globe are on a constant lookout for newer ways of operating with optimal efficiency. It is no longer a choice but a business imperative to become Remote First ensuring business continuity.

At Innominds, we help manage systems and engineer apps, devices, apply analytics to help ensure businesses stay resilient and successful at all times.

Our emerging technology solutions facilitate smoother, streamlined, and uninterrupted business operations. We bring forth the same ease, comfort, effectiveness, and work productivity to businesses and to employees that are working remotely.

Our AI/ML-powered data analytics services rise strong to this occasion, helping businesses operate and accelerate better through this pandemic. AI-powered data analytics platforms, like our AI/ML-powered iFusion analytics platform, can process millions of data records, coming from varied sources, trace out patterns, detect anomalies and provide meaningful predictive insights via visualizations.